- Shanghai Zhongshen International Trade Co., Ltd. - Two decades of trade agency expertise.

- Service Hotline: 139 1787 2118

Introduction

Automotive partsImporting is crucial for automotive aftermarket, maintenance services and vehicle manufacturing, but due to complex clearance procedures, tax calculations andInternational Logisticsbusinesses oftenImport RepresentationDoubts exist regarding the composition and reasonableness of costs. Based on 20 years of industry experience, this article systematically analyzes the core cost components of auto parts import agency and provides practical cost optimization suggestions to help enterprises efficiently plan import budgets.

I. Core Components of Automotive Parts Import Agency Fees

1.Tariffs and value - added tax

- TariffDetermined according to the HS code (Harmonized System code) and country of origin of the auto parts.

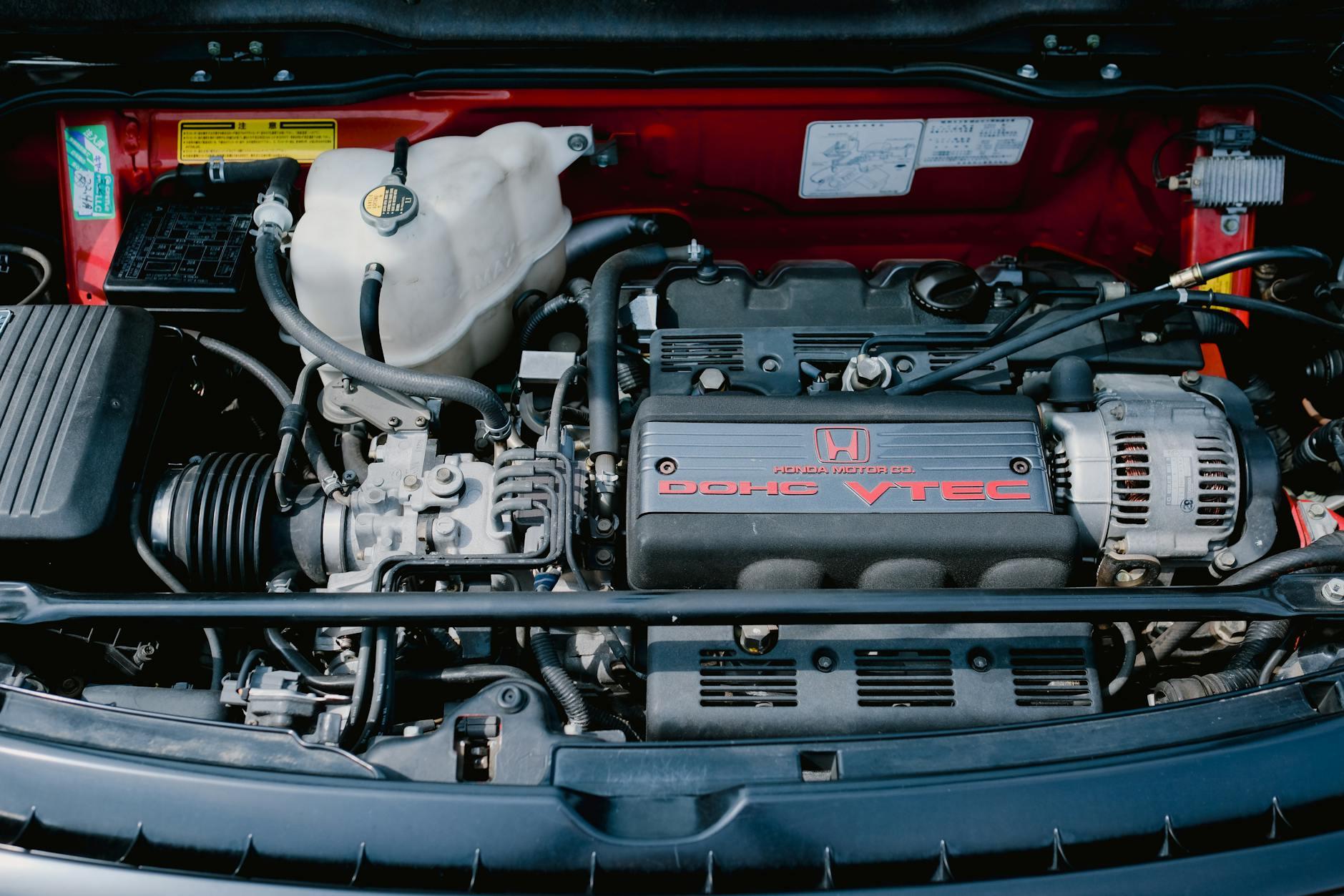

- Chinas import tariff rates for auto parts are typically 5%-25%(e.g., approximately 8% for engine parts, 10% for tires, and as low as 5% for electronic components).

- Some countries (such as ASEAN member states) enjoy preferential tariff rates under free trade agreements, even zero tariffs.

- Value - added TaxUniformly set at 13%(Chinas current standard), calculated based on CIF (Cost, Insurance, and Freight) dutiable value.

2.Customs declaration agency service fee

- Basic service fee: Includes document review, customs declaration, tax payment, etc., with a fee range of approximately 500-3000 RMB per shipment, depending on the cargo value, document complexity, and the agency companys pricing strategy.

- Additional service fees: Such as expedited customs clearance, inspection assistance, etc., may incur extra charges of 500-2000 RMB per instance.

3.International Transportation Fees

- Maritime Transportation: Mainstream transportation method, with costs fluctuating based on cargo volume (FCL/LCL) and shipping routes.

- For example: A 40HQ container from Germany to Shanghai Port, with sea freight costs approximately $4000-8000(including bunker adjustment factor).

- Air Transportation: Suitable for urgent orders, with costs about 3-5 times that of sea freight, calculated based on actual weight or volumetric weight.

4.Customs clearance miscellaneous fees

- Terminal handling charges (THC), documentation fees, seal fees: Approximately 800-1500 RMB per container.

- Customs inspection fees: If the goods are selected for inspection, the fee is approximately 500-2000 RMB(including yard fees and labor costs).

5.Domestic warehousing and distribution fees

- Port storage fees: Approximately 3-8 RMB per day per cubic meter(extended storage may incur high demurrage fees).

- Domestic distribution fees: Calculated based on destination distance, for example, trucking fees from Shanghai Port to Chongqing are approximately 2000-5000 RMB per container.

6.Certification and testing fees

- Some components require compliance with China Compulsory Certification (CCC) or EU E-mark standards, with testing costs approximately 10,000-50,000 RMB/model.

II. Key Factors Affecting Import Agency Costs

1.Component Attributes and Classification

- HS code misclassification may lead to tariff deviations (e.g. classifying wiper blades as electronic equipment), resulting in back taxes or penalties.

2.Trade Terms (Incoterms)

- FOB (Free On Board) and CIF (Cost, Insurance and Freight) directly affect tax calculation basis, requiring clear division of responsibilities.

3.Supply Chain Urgency Level

- Emergency requirements like air freight and expedited customs clearance may increase total costs by 20%-50%.

4.Policy Fluctuation Risks

- During China-US trade friction, additional tariffs (up to 25%) were imposed on some US-made components.

III. Case Studies of Cost Estimation

Case 1: Brake Pads Imported from Germany (1×40HQ container)

- Goods Value: $50,000 (CIF Shanghai)

- Customs Duty: 8% × $50,000 = $4,000

- VAT: 13% × ($50,000+$4,000) = $7,020

- Customs Agency Fee: ¥2,500

- Ocean Freight: $6,000

- Domestic Delivery: ¥3,500

Total: Approximately $63,520 (excluding warehousing and testing fees)

Case 2: Emergency Air Freight of Electronic Throttle from Japan (100kg)

- Air Freight: ¥15/kg × 100kg = ¥1,500

- Expedited Customs Clearance Fee: ¥2,000

- Duty+VAT: Approximately ¥8,700

Total: Approximately ¥12,200 (3-day delivery)

IV. Optimization Suggestions to Reduce Import Agency Costs

1.Accurate HS code classification

- Engage professional agents to verify component classification and avoid high tariff misjudgments.

2.Leverage Free Trade Agreements

- Prioritize procurement from countries with FTAs with China (e.g. South Korea, Australia) to enjoy tariff reductions.

3.Optimize the Logistics Plan

- Use LCL (Less than Container Load) to reduce small-quantity shipping costs, and book FCL (Full Container Load) in advance to secure favorable freight rates.

4.Obtain certification in advance

- Confirm whether accessories comply with Chinese standards before procurement to avoid return losses due to failed inspections upon arrival.

5.Select comprehensive service agents

- Cooperate with agents capable of door-to-door services, integrating customs clearance, logistics, and warehousing to reduce intermediary price differences.

Conclusion

The transparency and cost control of auto parts import agency fees rely on professional agency services and corporate collaborative planning. Through precise classification, policy interpretation, and supply chain optimization, companies can reduce overall costs by 10%-30%, gaining a competitive edge in the market.

(Note: Data in this article is based on 2023 industry averages. Actual fees are subject to specific business and policy changes.)

Originality StatementUnauthorized reproduction is prohibited. For citations, please contact the author.

Related Recommendations

? 2025. All Rights Reserved. Shanghai ICP No. 2023007705-2  PSB Record: Shanghai No.31011502009912

PSB Record: Shanghai No.31011502009912