- Shanghai Zhongshen International Trade Co., Ltd. - Two decades of trade agency expertise.

- Service Hotline: 139 1787 2118

Industry Status: Sustained Growth in Demand for Imported Auto Parts in Chinas Aftermarket

According to Ministry of Public Security statistics, as of June, 2023, Chinas motor vehicle fleet reached 430 million units, including 330 million automobiles. AgainstNew energythe backdrop of vehicle penetration exceeding 35%, market demand for imported parts shows structural changes:

1.Luxury vehicle maintenance demand: Annual imports of OEM parts for Porsche, Mercedes-Benz and other premium brands grew 18% (Customs 2023 data)

2.Shortage of new energy-specific components: Tesla 4680 battery modules and NIO battery swap station core components saw 210% year-on-year import growth

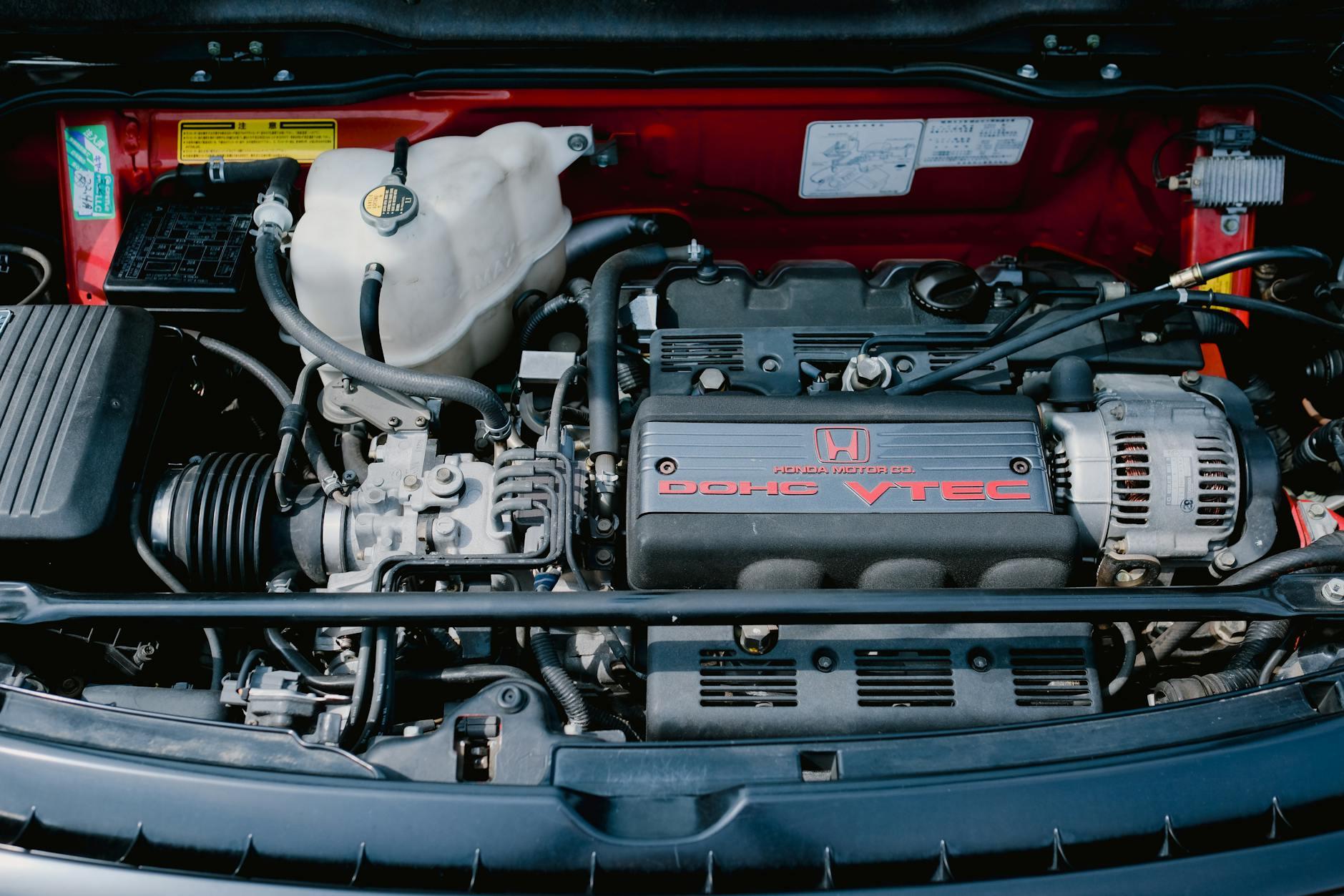

3.Modification market boom: Import declarations for Japanese RAYS forged wheels and German BILSTEIN shock absorbers increased 40% annually

Core Business Scenarios and Import Challenges

(Case: A German brand 4S dealer groups ¥230 million annual auto parts import project)

(1) Key business nodes

1.Product compliance review

- 3CDynamic management of certification catalog (2023 edition added 12 categories including new energy high-voltage wiring harnesses)

- Environmental standard upgrades (China 6b emission parts require EU ECE R49 test reports)

- Intellectual property record verification (involving special designs like BMW kidney grilles)

2.Apply for preferential treatment under the CIS Free Trade Agreement (tariff reduced from 12% to 6.5%)

- Engine blocks (HS 84099100) MFN tariff rate 8%

- Vehicle computers (HS 85372090) qualify for ITA agreement zero tariff

- Utilizing RCEP agreement for 3.8% tariff reduction on Japanese-made transmissions

3.Special Supervision Response

- Hazardous materials: Brake fluid (UN3066) requires dangerous goods classification certification

- Pressure vessels: New energy hydrogen storage tanks require special equipment licenses

- Used parts restrictions: Second-hand turbochargers prohibited from import

Comprehensive Process Service Solution (Taking Parallel Import Parts as an Example)

Case Background: Middle East Version Land Cruiser LC300 Parts Import Project

| Link | Key operation points | Risk Control |

|---|---|---|

| Overseas Procurement | Verify Differences Between Middle East Specifications and National Standards (e.g., Headlight Beam Patterns) | Sign Quality Assurance Agreement |

| Conduct pre - shipment inspection (China Certification & Inspection Group) | Use Temperature-Controlled Containers to Store ECU Modules | Purchase Transportation Insurance with Additional Electronic Equipment Damage Clause |

| Declaration for Customs Clearance | Separate Declarations to Avoid Mixed Classification Risks | Pre-Declaration System Verification of HS Codes |

| Warehousing and distribution | WMS System for FIFO (First In First Out) Management | Establish Genuine Product Traceability QR Code System |

Innovative Applications of Digital Solutions

1.Blockchain Traceability System: Achieve End-to-End Visual Tracking from Bosch Factory in Germany to Repair Shops in China

2.Intelligent classification system: Machine Learning-Based HS Code Recommendation Accuracy Rate of 98.7%

3.Customs Alert Platform: Real-Time Monitoring of U.S. EAR Control List Changes (e.g., Tesla Autonomous Driving Chips)

Special Scenario Response Strategies

1.Emergency Parts ShortageAir Transportation: Establish 72-Hour Emergency Channels at Frankfurt/Memphis Hubs

2.Recall Parts Return: Assist in Preparing Quality Defect Certificates for Tax-Free Returns

3.Cross-border E-commerceGoods preparation: Qianhai Bonded Warehouse launches the Porsche Optional Parts Pre-sale model.

Risk Management Matrix

| Risk types | Probability of occurrence | Impact Level | Countermeasures |

|---|---|---|---|

| Classification dispute | 25% | + Electronic pre - declaration | Apply for Pre-Classification Decision Letter |

| Quality Claims | 18% | Innovative Mode of Pre - customs Clearance at the Port | Designate TüV SüD for Pre-Shipment Inspection |

| Port Demurrage Fees | 30% | ★★★ | Establish a port emergency revolving fund pool |

| Exchange Rate Fluctuations | 40% | + Electronic pre - declaration | Use NDF for hedging |

Conclusion: Industry development trend forecast

1.Advancement of new energy testing and certification: Changes in testing requirements brought about by the conversion of UNECE WP29 regulations

2.Nearshoring of supply chain layout: Reconstruction of North American supply chains driven by the rise of Mexicos auto parts production capacity

3.Deepening application of compliance technology: AEO certification intelligent management systems will become industry standard

(Data sources: General Administration of Customs of China, China Association of Automobile Manufacturers, latest statistics from the U.S. Department of Commerce International Trade Administration)

Related Recommendations

? 2025. All Rights Reserved. Shanghai ICP No. 2023007705-2  PSB Record: Shanghai No.31011502009912

PSB Record: Shanghai No.31011502009912